Getting wealthy is less about IQ and more about behavior. There are certain things you can do this year that will set you up for a great 2024 money wise.

Open a Roth IRA Account (If you haven’t already)

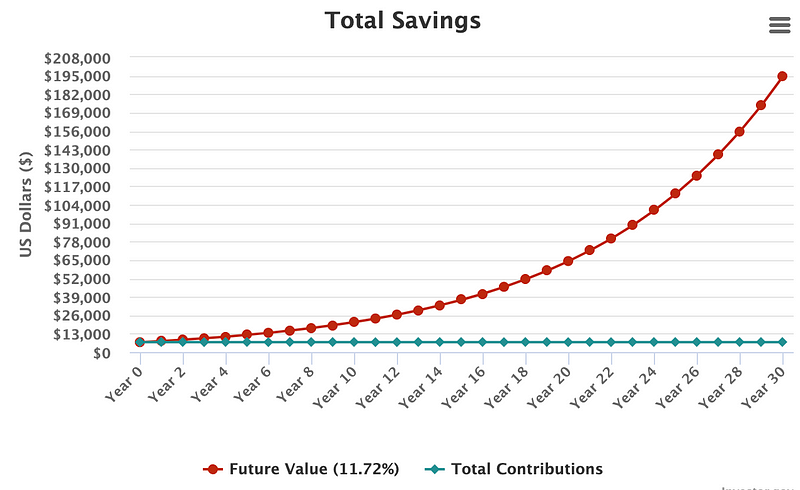

You may want to open and max out your Roth IRA account. You contribute post-tax income to a Roth IRA, where it grows tax-free. The Roth IRA annual contribution limit (2024) is $7,000 if you are under the age of 50. If you just invest this $7k in any S&P 500 index fund, your money, at the rate of 11.7% (historical S&P index average performance), will become $194,547.59 tax-free in 30 years. Just imagine how much money you can have if you contribute annually and invest religiously.

Here are a few of the interesting cases where people turned a small amount in their Roth IRA into a multimillion-dollar or even billion-dollar corpus.

Ted Weshler Turned $70,000 into $264 Million

Peter Theil Turned Retirement Account into $5Billion Tax Free

Automate your investment

The best way to stick to a habit is to remove friction from the process. If you plan to invest in 2024, you should set up a recurring deposit option in the brokerage account of your choice. Setting up a recurring deposit will take the negotiations with yourself out of the situation.

You can either choose any stocks of your choice or select a broad index fund. It’s useful to remember that very few people beat the S&P 500 in the long term. You may want to check out what happened when Warren Buffet made this bet against all hedge funds here.

“Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.”

Create An Emergency Fund

If you want to build wealth, the worst thing you can do is to sell your investments at the wrong time. You don’t want to stop the compounding process unnecessarily.

To protect yourself from doing that, you may want to save up and set aside some money for any emergency. This way, you will always be positioned well in life and won’t have to sell your stocks at the wrong time.

Contribute To Your 401 (k) Account

A 401(k) account is a tax-advantaged retirement savings plan offered by employers to their employees in the United States. One of the key benefits of a 401(k) is its tax benefits, as contributions are deducted from the employee’s taxable income, reducing their current tax liability.

Sometimes, employers match their employee’s contribution to their 401(k) account. If your employer can contribute to your 401k and you are not taking advantage of this, you are leaving free money on the table.

Thank you for reading!

I hope you liked the article, and if you did, feel free to leave a comment. You can also give a clap for motivation (yes, you can clap multiple times).

Connect with Devvrat Kumar

Let’s be friends! You can find me on Twitter, Substack and LinkedIn.

Leave a Reply